Written By Nik Koulogeorge

Written By

Published

Dec. 16, 2020

Updated

Nov. 21, 2021

If you want to improve your fraternity organization, then you need to understand how it works. Inter/national fraternities and sororities vary in their levels of transparency. Members may know that an administrative office or that some governing board exists, but few take the time to explore how they work. That's where Fraternity Man comes in!

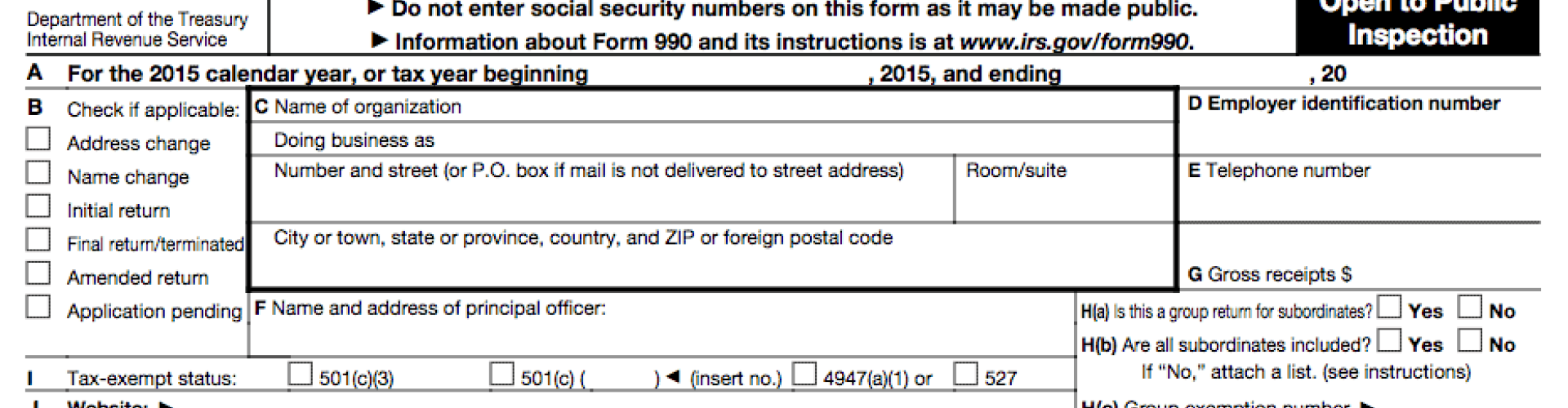

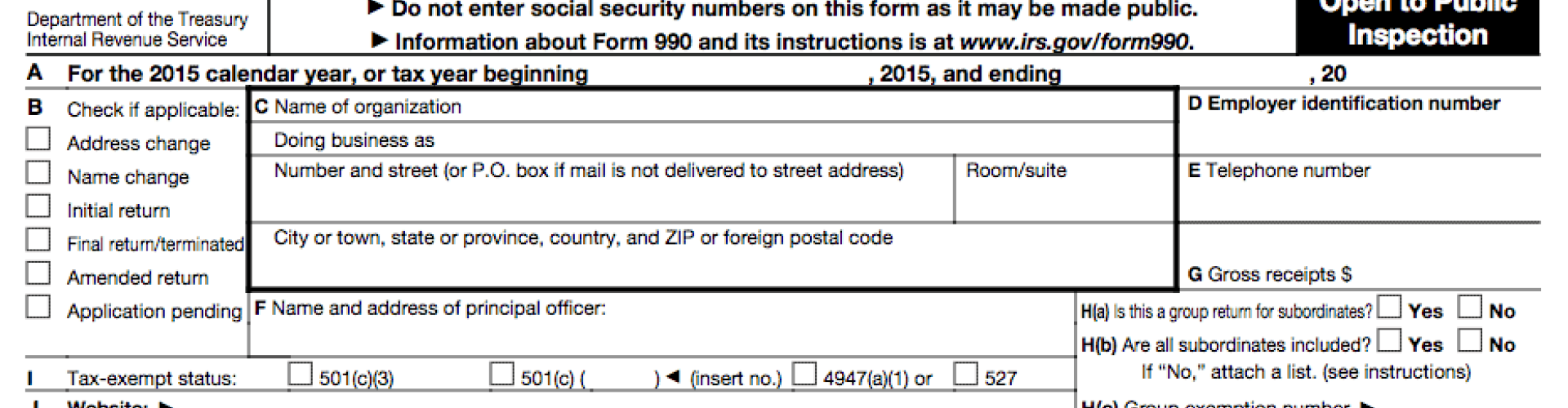

Each fraternity, sorority, fraternal foundation, and umbrella association files a Form 990 with the Internal Revenue Service (IRS) on an annual basis. These documents are publicly accessible, and they can reveal information about how your fraternity - functions.

Why I'm writing this post: First, this is a life skill that may be relevant to any members or new members who one day wish to donate to charity or serve on a nonprofit board. Next, fraternities and sororities are democratic organizations, and members in most swear some oath to help maintain their organization. Consider this as a great way to claim ownership over your fraternity experience.

Websites like ProPublica and GuideStar allow you to access the 990 of any nonprofit organization. Most forms are made viewable to the public one or two years after they are filed. You can also request access to your fraternity's or sorority's 990 from your elected leaders or administrative office staff. Your fraternity's 990 should indicate the end of its fiscal year (typically a summer month). So be kind and don't badger your fraternity's leaders for this year's 990 before "this year" technically ends. . . okay? #BeFriendly.

The most obvious thing you can learn about your fraternity or fraternal foundation from its 990 is its financial position. Check Line 19 in Part 1 to determine if your fraternity is spending more money than it takes in. Remember that losses are natural, but start asking questions if your fraternity is losing money for two or more years in a row. Fraternities rely primarily on dues for revenue, but a fraternal foundation relies on donations, so expect a little more fluctuation in the revenue of a foundation. Swings in revenue greater than 25% may be a cause for further investigation.

Line 22 will tell you what your fraternity or foundation has in reserves. This may take the form of property, investments, or liquid cash. That said, the property can be sold, and so this line may indicate how well your fraternity is positioned to handle a bad year. . . such as, say, a year in which a global pandemic demolishes brick-and-mortar education. Ken Breivick of Nehemiah Communications suggests that an organization keep as much or more in reserves than its current expenses. I am not saying he's right, only that it is a benchmark to keep in mind.

You can learn about what your fraternity pays its board and/or staff in Part 7. It may only list the salaries for the highest-paid individuals, but you can determine if that level of pay is appropriate for the size of your fraternity. Remember that many fraternity CEOs/Executive Directors are paid by both the fraternity and its educational foundation. Consider their pay in the context of the whole, as their pay may be weighted toward one or the other.

Part 8 of the 990 is the statement of revenue and will explain where your fraternity brings in money: dues, royalties, program fees, etc. Part 9 shows the functional expenses. Students would routinely ask me for our budget when I worked for my fraternity's national office. I was ignorant and didn't know to point them to the 990 at the time. You can learn how much your organization spends on expansion, educational programs, staffing, and more. Finally, Part 10 shows a balance sheet, which offers a context around Part 1, Line 19.

Your fraternity's 990 can tell you as much about how works as it does the fraternity's financial situation. I didn't learn this until I studied fraternal foundation 990's for an article on how much fraternities give in academic scholarships.

The fraternity's or foundation's stated mission will be listed in Part 3. This may not be new to you, but it can be interesting to see how your fraternity presents itself to the public/IRS. Lines 4a, 4b, & 4c are where nonprofits are expected to list their greatest program accomplishments. Many fraternities list leadership programs in this space. They may also indicate how much of an organization's budget is dedicated to any of these programs, but many organizations leave those parts blank. (If that space is blank, then it cannot hurt to ask.)

Check to see if any boxes are checked "yes" in Part 4 of your fraternity's 990. This section indicates which additional forms your organization may be required to file. These additional forms indicate that something about how your organization works differs from the norm of most nonprofits. That is not necessarily a bad thing, but it can be informative. For example, you can learn about political activity/lobbying, use of outside/professional fundraisers, or if someone is profiting or receiving benefits from the organization when they otherwise shouldn't (board members, disqualified persons).

Part 6 of your fraternity's 990 will tell you about your organization's governance and its infrastructure. This is important for anyone interested in organizational transparency or leadership. Remember that this is all publicly available. You as a member - more than anyone else - have an interest in exploring how your fraternity works.

This includes the number of board members (Line 1a) and if they can all vote (Line 1b).

Are there family or business relationships intermingled with the board (Line 2)?

Does the board and its committees keep minutes (Line 8a/8b)?

Does the board distribute its 990 before they file (Line 11a)?

Does the board have a conflict of interest policy (Line 12a)?

990s are public records and the public should be able to get a copy, Line 18 tells the method for someone to get a copy. (Most in my incomplete study appear to be "upon request")

Not every fraternity man will or should care to pour through an organization's tax documents. It makes for good practice; however, as charitable giving and volunteering with nonprofits is a general expectation of fraternity men. Furthermore, our organizations are democratic and our leaders are elected. It is okay to use good, public information to inform your votes, your questions, and your positions on issues related to your fraternity.

Have questions? Want help exploring your fraternity's or fraternal foundation's 990 document(s)? Slip into my DM's on Twitter, Facebook, or Instagram with questions!

Fraternity Man is an ad-free and independent publication. Help keep it going and growing by contributing as little as $2. (Links below will take you to a secure payment portal via Stripe)

A free way to support: Subscribe to the Fraternity Man newsletter for [very occasional] updates and giveaways.